Top 5 Buyer Financing Questions Answered

If you're thinking about buying a home in Phoenix, you're not alone—and neither are your questions. The financing part of homebuying can feel overwhelming, especially when you're navigating it for the first time. Between confusing mortgage jargon, worries about your credit score, and concerns about saving enough for a down payment, it's easy to feel stuck before you even start.

Here's the good news: understanding the basics of mortgage financing is simpler than you think. Once you know what to expect, you can move forward with confidence and start turning your homeownership dreams into reality.

We've compiled the five most common financing questions homebuyers ask—along with clear, straightforward answers that will help you take your next steps toward owning a home in the Phoenix market.

Question 1: How Much Do I Really Need for a Down Payment?

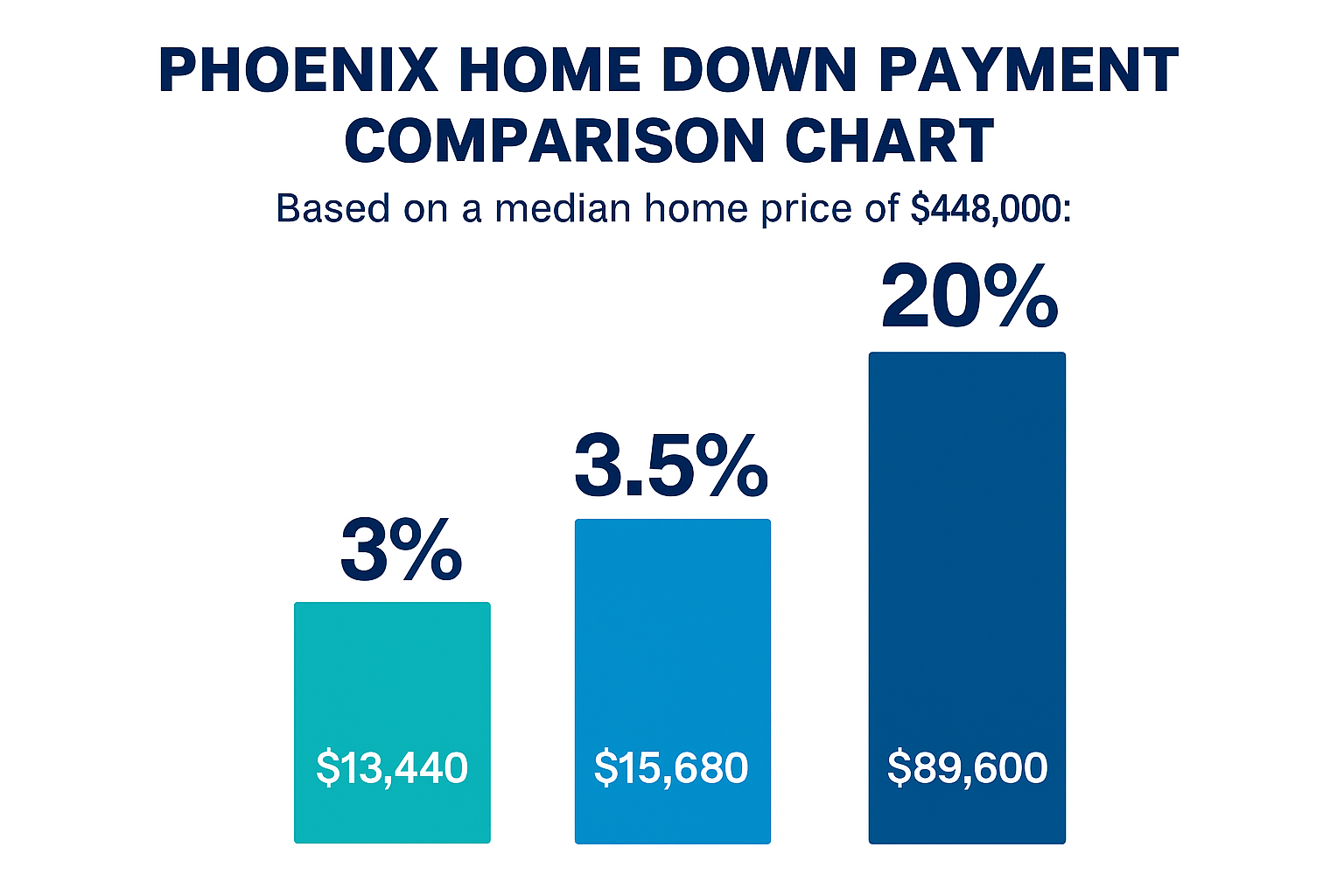

This is hands down the most common question we hear, and it's often the biggest source of confusion. Many buyers think they need to save 20% before they can even think about buying a home. The truth? That's simply not the case anymore.

Here's what you actually need to know:

While a 20% down payment can help you avoid private mortgage insurance (PMI) and potentially secure better loan terms, it's far from your only option. In fact, there are several loan programs designed specifically to help buyers with lower down payments:

Conventional loans can require as little as 3% down, especially for first-time buyers

FHA loans require just 3.5% down and are popular among first-time buyers due to more flexible credit requirements

VA loans offer 0% down payment options for eligible veterans and active-duty military personnel

USDA loans also offer 0% down for properties in qualifying rural areas

Additionally, there are down payment assistance programs available in Arizona that many buyers don't even know exist. These programs can provide grants or low-interest loans to help cover your down payment and closing costs.

Phoenix market context: With the median home price in Phoenix hovering around $450,000-$460,000 as of 2025, a 3.5% down payment would be approximately $15,750—much more manageable than the $90,000 a 20% down payment would require.

The key takeaway? Don't let the down payment myth hold you back. Focus on what you can realistically save while exploring assistance programs that might be available to you.

Question 2: What Credit Score Do I Need to Get Approved?

Credit scores feel like this mysterious, all-powerful number that determines your homebuying fate. But while your credit score is important, it's not the impossible barrier many people fear it to be.

The real numbers:

Most mortgage lenders have minimum credit score requirements that vary by loan type:

FHA loans: Typically require a credit score of 580 or higher (some lenders may go as low as 500 with a larger down payment)

Conventional loans: Usually require scores of 620 or higher

VA loans: While the VA doesn't set a minimum score, most lenders prefer 620+

USDA loans: Generally require 640 or higher

If your credit score is below these thresholds, don't panic. You have options. Many buyers work on improving their credit for six months to a year before applying for a mortgage. Simple steps like paying bills on time, reducing credit card balances, and avoiding new debt can make a significant difference.

What if you don't have much credit history? Some loan programs will consider alternative credit data, like rent and utility payments, to evaluate your creditworthiness.

Remember, your credit score affects more than just your approval—it also impacts your interest rate. Higher scores typically qualify for lower rates, which can save you thousands over the life of your loan.

The bottom line: While good credit helps, you don't need a perfect score to buy a home. Our team has loan officer partners who can evaluate your specific situation and help you understand exactly where you stand.

Question 3: How Much House Can I Actually Afford?

This question gets to the heart of responsible homebuying. You might get approved for a certain loan amount, but that doesn't necessarily mean you should borrow that much. The goal is to buy a home you can comfortably afford—not one that stretches your budget to the breaking point.

Understanding affordability:

Lenders typically use what's called your debt-to-income ratio (DTI) to determine how much you can borrow. They look at your monthly income compared to your monthly debt obligations (credit cards, car loans, student loans, and your proposed mortgage payment).

Most lenders prefer to see a DTI of 43% or lower, though some loan programs allow higher ratios under certain circumstances. However, just because a lender approves you at that level doesn't mean it's comfortable for your lifestyle.

A better approach:

Consider these factors when determining your budget:

Your current monthly expenses and spending habits

Emergency savings (aim for 3-6 months of housing expenses)

Other financial goals (retirement, kids' education, vacations)

The true cost of homeownership beyond your mortgage (property taxes, insurance, HOA fees, maintenance, utilities)

Phoenix-specific considerations: Property taxes in Arizona are relatively affordable compared to other states, but insurance costs have been rising. Factor in cooling costs during our hot summers, which can be significant. Also, many Phoenix communities have HOA fees that can range from $50 to several hundred dollars per month.

A general rule of thumb: your housing payment (including principal, interest, taxes, insurance, and HOA) shouldn't exceed 28-30% of your gross monthly income. This leaves room for other expenses and unexpected costs that inevitably come with homeownership.

Question 4: What's the Difference Between Pre-Qualification and Pre-Approval?

These terms sound similar, but they're actually very different—and understanding the distinction can give you a competitive edge in the Phoenix market.

Pre-qualification is the first step. It's a quick, informal process where you provide basic financial information to a lender, and they estimate how much you might be able to borrow. No verification, no deep dive into your finances—just an educated guess. While it's a good starting point, a pre-qualification letter won't impress sellers.

Pre-approval is the real deal. This involves submitting actual documentation (pay stubs, bank statements, tax returns, etc.) for the lender to review and verify. They'll pull your credit report and thoroughly assess your financial situation. If approved, you'll receive a pre-approval letter stating the specific loan amount you qualify for.

Why this matters in today's market:

In Phoenix's current market conditions, where inventory is increasing but competition still exists for well-priced homes, having a pre-approval letter shows sellers you're a serious, qualified buyer. Many sellers won't even consider offers from buyers who aren't pre-approved.

Getting pre-approved also benefits you in other ways:

You'll know your exact budget before house hunting

You can move quickly when you find the right home

You'll identify any potential issues with your finances early, giving you time to address them

It can strengthen your negotiating position

Pro tip: Pre-approvals are typically good for 60-90 days, so time your application accordingly. Also, avoid making major financial changes (like switching jobs or taking on new debt) during the homebuying process, as these can affect your approval status.

5: Should I Wait for Interest Rates to Drop?

This is the million-dollar question we're hearing constantly in 2025. With mortgage rates higher than the historic lows of 2020-2021, many buyers are wondering if they should wait for rates to come down.

Here's what you need to understand about the "waiting game."

The reality of rate timing:

Yes, mortgage rates are higher than they were a few years ago, currently hovering around 6-7% for a 30-year fixed mortgage. And yes, if rates drop significantly, you'll be able to afford more house for the same monthly payment.

But here's what many buyers miss: you can always refinance later when rates drop, but you can't go back in time to buy a house at yesterday's price.

What's happening in the Phoenix market right now:

Phoenix home prices have shown remarkable resilience. While price growth has moderated from the explosive gains of recent years, most forecasts predict prices will continue rising steadily through 2025 and beyond. Some experts project the median Phoenix home price could reach $650,000 by 2030.

Meanwhile, inventory levels are improving, giving buyers more choices and negotiating power than we've seen in years. Homes are staying on the market longer, and more sellers are offering price reductions and concessions.

The math you need to consider:

Let's say you wait a year for rates to potentially drop 1%. That sounds great—until you realize that home prices might increase 4-5% during that same year. You could end up paying significantly more for the same house, completely negating any savings from the lower interest rate.

What about refinancing?

Here's a key strategy many buyers are using: buy now while you have choices and negotiating power, then refinance when rates drop. You can't refinance a home you don't own. By getting into a home now, you're building equity, enjoying homeownership benefits, and positioning yourself to refinance later if rates improve.

The bigger picture:

Beyond the numbers, there's the personal equation. How much longer do you want to pay rent (money you'll never see again) while waiting for perfect market conditions that may never materialize? What's the emotional and lifestyle cost of delaying your homeownership dreams?

Nobody has a crystal ball about future interest rates or home prices. What we do know is that the Phoenix market remains strong, inventory is improving, and opportunities exist right now for prepared buyers.

Understanding What's Really Holding Phoenix Buyers Back

Now that we've answered the top financing questions, let's address the real barriers keeping Phoenix homebuyers on the sidelines—and how to overcome them.

The affordability squeeze: Elevated rates combined with limited inventory at affordable price points create the biggest challenge. Many Phoenix buyers struggle to find homes within their budget.

Down payment hurdles: With rising living costs and existing debts, saving thousands for a down payment feels overwhelming for many buyers.

The information gap: First-time buyers often find the mortgage process confusing—the paperwork, terminology, and timelines can feel like too much.

Here's how to move forward:

Explore all your loan options, including low-down-payment programs and Arizona's down payment assistance programs (over 2,500 exist nationwide, and most buyers don't know about them). Consider up-and-coming Phoenix neighborhoods like South Phoenix, Maryvale, and the Peoria Corridor, which offer strong appreciation potential at more accessible entry points.

Take advantage of HUD-approved homebuyer education classes to demystify the process. Set up automatic savings transfers to build your down payment fund. Most importantly, work with a knowledgeable real estate professional who understands the Phoenix market and can guide you through each step with confidence.

The Phoenix Market Right Now: What You Need to Know

Understanding the local market conditions helps you make smarter decisions. Here's where things stand in Phoenix as of 2025:

Inventory is increasing: After years of extremely tight supply, active listings have grown significantly. This means more choices for buyers and less intense competition than we saw during the pandemic housing boom.

Prices are stabilizing: While prices remain elevated compared to pre-pandemic levels, the growth rate has slowed considerably. Some areas have even seen slight price decreases, though the overall trend is still upward.

Negotiation is back: With homes staying on the market longer and more price reductions happening, buyers have more negotiating power. Seller concessions and flexible terms are becoming more common.

It's a shifting market: Phoenix is transitioning from a strong seller's market to a more balanced market. This creates opportunity for buyers who are prepared and can move when they find the right property.

The forecast looks stable: While nobody can predict the future with certainty, most experts project steady, moderate appreciation in Phoenix home values over the next several years. The fundamentals remain strong: job growth, population growth, and relative affordability compared to coastal markets.

Your Next Steps: Moving from Questions to Action

Understanding the financing basics is just the beginning. Here's how to turn that knowledge into action:

Step 1: Get your financial house in order. Pull your credit report, review your budget, and start saving for your down payment if you haven't already. Look for areas where you can cut expenses and redirect that money toward your homebuying goal.

Step 2: Research assistance programs. Don't assume you won't qualify for help. Many programs have more flexible requirements than you might think.

Step 3: Connect with the right professionals. Our team can help you navigate the Phoenix market and connect you with trusted loan officer partners who can evaluate your specific situation and present your options clearly.

Step 4: Get pre-approved. Once you understand where you stand financially, get a real pre-approval (not just a pre-qualification) so you're ready to act when you find the right home.

Step 5: Start your search. With pre-approval in hand and a clear understanding of your budget, you're ready to begin looking at homes. Remember, inventory levels in Phoenix are improving, so take your time and find a property that truly fits your needs and budget.

Ready to Get Started?

The homebuying journey doesn't have to be overwhelming. With the right information and support, you can navigate the financing process with confidence.

I've worked with countless Phoenix buyers and learned from trusted lender partners and past clients. I understand the questions keeping you up at night and the concerns making you hesitate.

Here's how I can help: I'm available to discuss the Phoenix market, your goals, and how to get started. When you're ready to explore specific mortgage options and get pre-approved, I'll connect you with my exceptional loan officer partners who specialize in helping buyers find the right financing solution.

Schedule Your Free Discovery Call. No pressure, no obligation—just honest conversation about your next steps. Whether you're ready now or need time to prepare, let's create a plan to reach your homeownership goals.

Don't let financing questions hold you back. Let's get your questions answered and map out your path to homeownership in Phoenix.

The Phoenix housing market is full of opportunities for buyers who understand the process and have the right support. Let's work together to make your homeownership dreams a reality.